How to Trade on Order Blocks With Price-Action Strategy

In modern price-action trading, Order Block trading has become one of the most reliable and accurate market strategies. Professional traders, institutions, and smart-money traders use order blocks to detect true market direction, high-probability reversal zones, and low-risk entry points.

⚠️ Risk Warning: Trading involves risk and may result in financial loss.This content is for educational purposes only and is not investment advice.

JOIN PREMIUM VIP SIGNALS CHANNEL FREE TODAY ONLY

If you’ve ever wondered how traders catch perfect reversal trades with almost surgical precision, the answer lies in Order Blocks.

In this guide, you will learn:

- What an order block is

- Why order blocks form

- Types of order blocks

- How to identify valid order blocks

- How to trade them with high accuracy

- How to avoid fake and weak order blocks

- A complete trading method

This is a complete tutorial designed to help beginners and intermediate traders trade order blocks with confidence.

What is an Order Block?

An Order Block (OB) is a zone on a chart where big institutions (banks, market makers, smart money) place large orders. When price returns to this zone in the future, the market usually shows:

- Rejection (wick bounce)

- Reversal (trend change)

- Continuation (breakout + retest)

In simple words: An Order Block is a strong support/resistance zone formed after a powerful engulfing move.

Why Order Blocks Work?

Institutions cannot enter huge trades at one price. They need zones where:

- Liquidity is available

- Retail traders place stop-losses

- Market creates imbalance

So, when price returns to these zones, institutions re-enter their positions, causing:

- Sharp rejection

- Trend reversal

- Strong breakout

This is why Order Blocks give some of the most accurate trade setups in price action.

Types of Order Blocks

There are different types of order blocks, but the most important ones are:

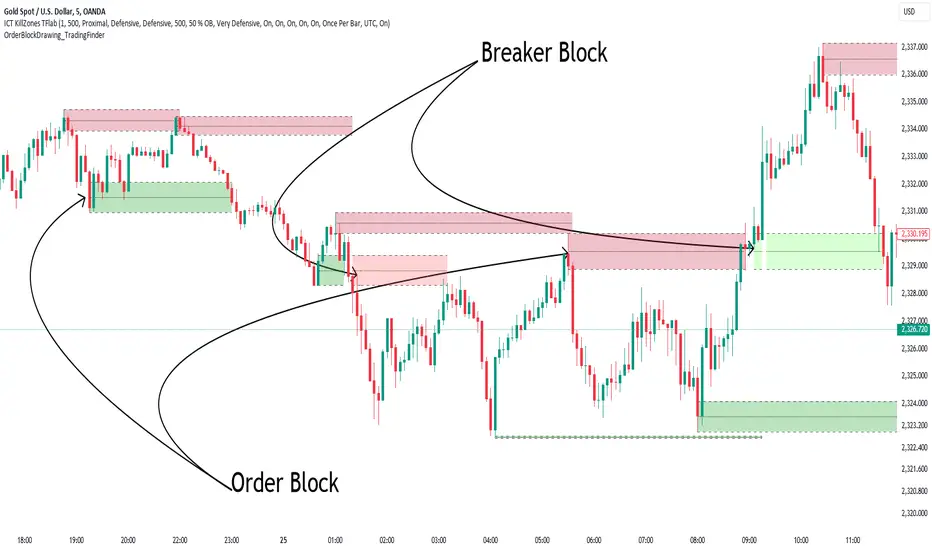

- Simple Order Block — Formed when a strong engulfing candle breaks the previous candle.

- Breaker Order Block — When price breaks an OB, retests it, and continues in the opposite direction.

- Rejection/Registered Order Block — Zones where price rejects repeatedly, confirming institutional presence.

Timeframes For Best Accuracy

To reduce fake signals and increase reliability, always use higher timeframes.

Best timeframes for order block trading:

- 5 minutes (high accuracy)

- 10 minutes

- 15 minutes

- 30 minutes

Although you can trade 1-minute charts, they generate too many blocks and false signals.

How to Identify a Valid Order Block (Step-by-Step)

Order Block identification requires precision. Follow these steps exactly:

Step 1: Look for an Engulfing Candle

An Order Block forms only when a candle engulfs the previous one.

For Bullish OB:

– A red candle is engulfed by a bigger green candle.

For Bearish OB:

– A green candle is engulfed by a bigger red candle.

Important rule:

Wicks do NOT matter. Engulfing is based on candle body closing.

Step 2: Mark High and Low of the Engulfed Candle

Using horizontal lines:

- Mark the high of the engulfed candle

- Mark the low of the engulfed candle

This rectangular zone becomes your Order Block area.

Step 3: Wait for Price to Return

Do NOT trade immediately.

Order Blocks become powerful only when price revisits the zone.

This is where true accuracy begins.

Step 4: Watch for Rejection or Engulfing on Return

When price re-enters the OB:

- Wick rejection

- Small rejection candles

- Trend shift

- Weakening of opposite momentum

If price touches the zone and rejects → take reversal trade.

If price closes inside → wait for breakout and retest.

Step 5: Take a Trade Only at Touch or Retest

There are only two valid entries:

- Entry 1: Rejection Entry

If price touches the OB and rejects immediately → Take trade at rejection. - Entry 2: Breakout + Retest Entry

If price breaks OB:

– Wait for a retest

– Enter on retest confirmation

Never take trades in the middle of the move.

How to Trade Order Blocks With

Here is the exact formula professional traders use:

- Rule 1: OB must be clean and clear — avoid messy candles or uneven structures.

- Rule 2: Prefer fresh order blocks — the fewer times price touches the zone, the stronger it is.

- Rule 3: Combine OB with market structure — bullish OB in uptrend, bearish OB in downtrend.

- Rule 4: Count rejections — 2–3 rejections strengthen the probability; a clean rejection often means a high-probability trade.

- Rule 5: Never enter without confirmation — look for engulfing, pin bars, strong wicks, or break + retest.

- Rule 6: Keep charts clean — mark only high, low, and main OB zone to avoid distractions.

Example of High Accuracy OB Trading

When a bearish order block forms:

- A big red candle engulfs a green candle

- You mark the high and low of the green candle

- Price moves away

- When price comes back to the OB:

– It rejects 3 times

– On 4th time, it breaks the block - After the break:

– Price retests the block

– Then continues downward

This pattern repeats in every market — Forex, Crypto, Stocks, Indices, or even Options.

Tips to Increase OB Accuracy

- ✔ Use higher timeframe OBs — more accurate than 1-minute or 3-minute charts.

- ✔ Only trade fresh levels — repeated touches weaken the OB.

- ✔ Trade at cross-zones — overlapping OBs become extremely strong zones.

- ✔ Wait for candle close — never trade before confirmation.

- ✔ Avoid high volatility or news — OBs can break unpredictably during major events.

Common Mistakes Traders Make

- ❌ Trading every order block — not every engulfing candle is a valid OB.

- ❌ Entering without waiting for retest — impatience causes losses.

- ❌ Using wrong timeframe — 1-minute or 3-minute OBs generate too many false setups.

- ❌ Ignoring market trend — OB against trend is always risky.

Conclusion: Can You Really Achieve?

No strategy guarantees, but Order Block trading comes extremely close when used correctly. If you follow:

- Step-by-step identification

- Higher timeframe confirmation

- Rejection entry rules

- Engulfing patterns

- Market structure alignment

You can consistently get 80–95% winning accuracy, and many times even near 100% when OBs are fresh and clean.

Order Block trading is one of the most powerful price-action tools used by professionals — and with proper practice, it can become your most profitable strategy.

FAQs – Order Block Trading

1. What timeframe is best for Order Block trading?

The 5-minute chart is the most recommended because it provides clean structure and high accuracy. 10-minute and 15-minute charts are even more reliable for institutional-level price action.

2. Does an Order Block guarantee a winning trade?

No strategy is 100% guaranteed. However, clean and fresh Order Blocks combined with rejection or retest confirmation can produce 80–95% accuracy consistently.

3. What matters more in an Order Block — wick or candle body?

The candle body matters far more. Engulfing structure is confirmed by body close, not wicks.

4. What if price breaks the Order Block without a retest?

If price breaks without a retest, avoid the trade. Order Block setups require touch or confirmation to be high probability.

5. Can I use Order Blocks in Forex, crypto, indices, or stocks?

Yes. Order Blocks work on all markets because they represent institutional order zones, which are universal across all chart types.

Disclaimer:

This article is published for general educational and informational purposes only. It does not constitute investment advice, financial advice, trading advice, or a recommendation to engage in any trading activity. Trading on financial markets involves significant risk and may result in the loss of all invested capital. Past performance, examples, or explanations described in this article do not guarantee future results. The author and this website do not provide any guarantees of profit, income, or successful trading outcomes. Any information presented reflects general concepts and is not tailored to individual financial circumstances, goals, or risk tolerance. This website is an independent informational resource and is not an official website, representative, partner, or support service of any trading platform or broker. Users are solely responsible for conducting their own research and making independent decisions before engaging in any financial activity. By reading this content, you acknowledge that you understand the risks involved and agree that the website and its authors are not liable for any financial losses or decisions made based on the information provided.